You Are Defined By Your Worst Day, Not Your Best

Most people want to talk about their best day. The day they made a bunch of money, launched their business, or replaced their income with their side hustle. And it’s incredibly important to celebrate these victories.

But what these winners don’t talk about is what they did on their worst day. This is the day that matters the most because their story didn’t end. They survived to keep playing the game.

Your life is defined by what happens on your worst day, not your best.

At some point, you are going to have to face the downside of one (or many) of your decisions. Whether it’s an investment decision, business decision, or personal decision, one of them, at some point, will turn on you.

And when that happens, the most important thing is that you avoid ruin.

That’s why I’m so adamant about seeking out and executing asymmetric opportunities. These are opportunities where the upside is much greater than the downside. And the downside is capped.

For example, when you buy a stock, the worst thing that can happen is the stock price goes to zero. The downside is clearly defined and capped. Meanwhile, the upside is uncapped. A stock has no limit on how high it can go.

When you can define and cap the downside, you can prepare for it. You can put together an action plan if your worst-case scenario begins to unfold. And that preparation will help you avoid ruin.

Don’t be a turkey.

Consider that the worst day of a turkey’s life is also its last.

Nassim Nicholas Taleb, in his book, The Black Swan: The Impact of the Highly Improbable, exemplifies the Black Swan problem with a turkey’s life. A “Black Swan” event is a rare event of enormous consequence that can’t be predicted or calculated for.

Taleb writes:

Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race “looking out for its best interests,” as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.

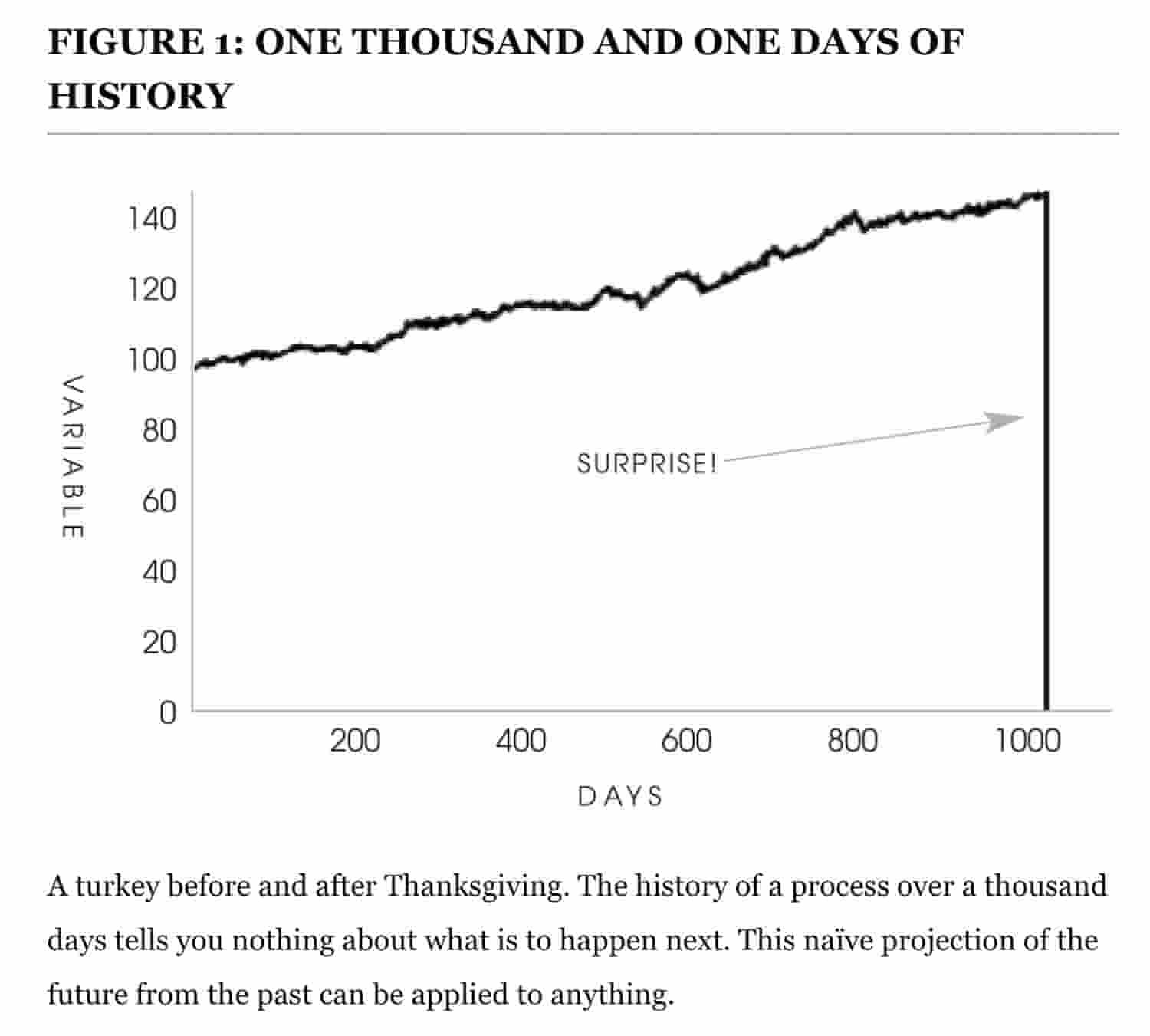

What happens on the Wednesday before Thanksgiving? The turkey is slaughtered to be eaten. Here’s the turkey’s life in chart form, courtesy of Taleb:

An illustration of the Black Swan problem from Nassim Nicholas Taleb’s book, The Black Swan: The Impact of the Highly Improbable.

This is the worst day of the turkey’s life, and it did NOT avoid ruin.

Even worse is that the turkey, Taleb explains, had no way to know that something like this was coming. All of its prior experience led it to believe that humans were its great friends who only had their best interests at heart. It was wrong.

On your worst day, you have to find a way to avoid being a turkey. That is, you have to have put into place as many ways as you can think of to avoid ruin if the worst-case comes to pass.

Inversion can help you survive your worst day.

Inversion is the practice of thinking through problems in reverse. It’s asking how an endeavor could fail, and then being careful to avoid those pitfalls.

It’s also recognizing that there are just some things you can’t protect against because you can’t see the risk!

Remember the turkey? There was no reasonable way for it to know what was coming based on its prior experience. The same can be said for you and I. There are just some things we can’t anticipate.

That’s why Taleb recommends trying to protect yourself against general Black Swan events, not specific ones. An emergency fund with 6-months worth of income will protect you if you lose your job AND if you lose your job because of a global pandemic that shatters the economy.

If you Watch the downside Closely enough, The upside will take care of itself.

Charlie Munger and Warren Buffett have built their investing career by watching the downside. They invest with an ample margin of safety so that the random “vicissitudes of life” (as Munger calls them) will not ruin them on their worst day.

Warren Buffett thinks long and hard about how he could lose money on an investment and then structures every deal in such a way to cap his downside. He’s built Berkshire Hathaway with this philosophy.

So, the next time you hear someone talk about how they’ve achieved something great, remember that they had to survive their worst day to get there.

If you watch the downside closely enough, the upside takes care of itself.

Sources: Taleb, Nassim Nicholas. The Black Swan: Second Edition: The Impact of the Highly Improbable (Incerto). Random House Publishing Group. Kindle Edition.