Asymmetric Outcomes: How You Can Win Despite Bad Odds

We all have a little voice of discouragement in our heads. The one that tells us that our pursuit is so unlikely to succeed, we shouldn’t even bother.

And that voice is right… sort of. The odds of you achieving what you want to achieve are probably terrible. If they’re not, you need to think bigger.

For example, say you want to find success as an entrepreneur or an actor or a writer. The odds you will win at that game are tiny. Let’s say they’re 1/1000. That means there’s a 999/1000 chance you won’t land that next role, your new product won’t find product/market fit, or your next book won’t sell a single copy.

Should you just give up? No, because you can’t just look at the odds of something happening - you have to consider the asymmetric outcomes.

Asymmetric Outcomes Can Skew A Bet In Your Favor.

Nassim Nicholas Taleb explores this idea in his book, Fooled By Randomness: The Hidden Role of Chance in Life and in the Markets.

If you have 999/1000 chance of failure, and 1/1000 chance of success, these are called asymmetric odds. They are not equal (unlike like a 50/50 coin toss, which has symmetric odds). The probability of failure is much higher than the probability of success.

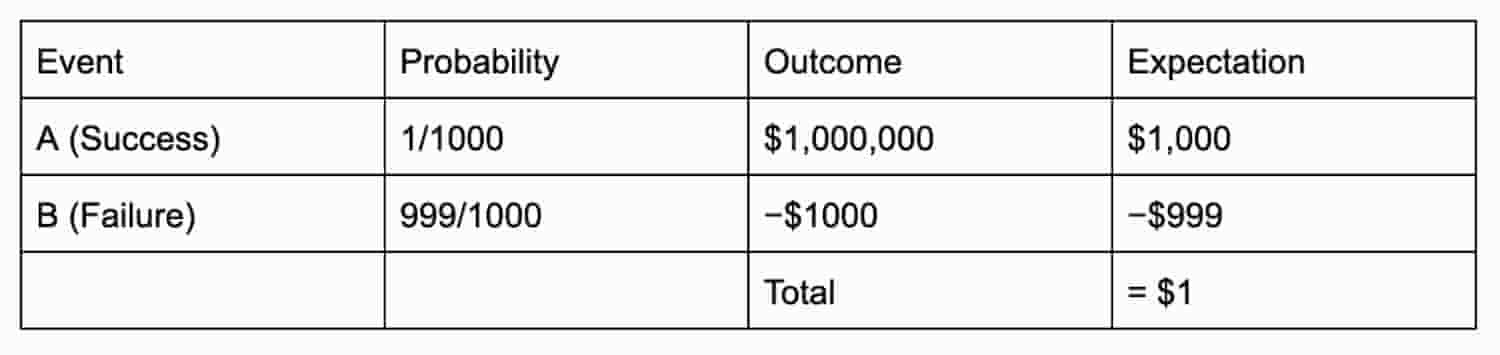

Let’s look at the outcomes - the payoff for each scenario. Say the payoff for success (1/1000 odds) is $1 million. So if you do write a hit book, manage to create a killer product or book a lead role on a TV show, you’ll get paid $1 million.

But if you fail (999/1000 odds), you lose $1,000. That could be the cost of supplies to prepare for the opportunity or the value of your time. So 999 times out of 1000, you’re going to lose $1,000.

These are called asymmetric outcomes - the outcomes are not the same. You either win $1 million or lose $1,000 (not $1 million).

With these odds and outcomes, can you expect to come out on top?

Yes! Because the expected total is positive for this scenario.

You can expect to make $1 (calculated by multiplying the probability by the expected outcome).

Here’s the scenario in chart form (format borrowed from Taleb):

Even though the odds are terrible, the asymmetric outcomes skew this bet to give you a positive expected total.

Here’s what Taleb writes in Fooled By Randomness:

“It is not how likely an event is to happen that matters, it is how much is made when it happens that should be the consideration. How frequent the profit is irrelevant; it is the magnitude of the outcome that counts.”

The above example is a revised version of the bet Taleb describes in his book, except he reverses the asymmetric odds with his bet heavily favoring winning.

Say you have 999/1000 odds of making $1 and 1/1000 odds of losing $10,000. Again, we see asymmetric odds and asymmetric outcomes. Should you make this bet day-after-day?

When you run the expected total, the answer is no. You can expect to lose about $9, even though your odds of winning are so much better than your odds of losing. It’s the size of the outcome that matters.

Look For Opportunties Where The Upside Is Massive And The Downside Is capped.

This is why I try to seek out iterated asymmetric opportunities where the upside is massive - the larger the asymmetric outcome, the less the odds matter. Sure, it’s not likely that any of my bets will payout. But if the payout is large enough, then as long as I can keep making iterated bets relatively quickly, the expected total is positive.

And the bet is even more attractive if I can keep my losses capped. Say I can lower my loss to only $500 (instead of $1000). Suddenly, the expected total for my 1/1000 chance of success becomes $500.50 ($1,000 − $499.50).

That’s why I prefer to pursue opportunities that cost me nothing but time. If I can get my expected loss to $0, there is only upside.

Taleb sums up his career as a trader as so:

“I try to benefit from rare events, events that do not tend to repeat themselves frequently, but, accordingly, present a large payoff when they occur.”

Taleb is making bets on rare events that have low odds of occurring, but which have huge upsides.

And this approach worked for him. I’ve read that Taleb made his fortune (about $35 million) on a lucky break using this strategy during the 1987 stock market crash. Apparently, he had a position in mostly worthless out-of-the-money Eurodollar future puts (the right to sell a contract at a designated strike price in the future) that became extremely profitable during the historic crash.

Yes, he was lucky. But he was also in a position to gain from an unlikely positive Black Swan event. The asymmetric outcome meant that he could win despite unlikely odds.

So the next time that voice in your head tells you that your pursuit is unlikely to succeed, tell him (or her) to beat it. With a large enough payout and enough iterations, it may be worth it.

If You Want More Content Like This Then Subscribe To My Newsletter For Free:

—

Taleb, Nassim Nicholas. Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets (Incerto). Random House Publishing Group. Kindle Edition.